Employee Retention Credit: What You Need to Know

The Employee Retention Credit (ERC) is a refundable payroll tax credit for up to $5,000 per employee in 2020 and $28,000 in 2021. This temporary credit was enacted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and amended by the Consolidated Appropriations Act of 2021 (CAA). On March 11, 2021, the American Rescue Plan Act (ARPA) of 2021 was signed, which further extended the credit through the remainder of 2021. In total, the potential per-employee payroll refundable credit for the combined 2020 and 2021 period is $33,000.

Based on our analysis of all ERC guidance (including the recent IRS Notice 2021-20 published on March 1, 2021 and the ARPA), we’ve developed services to help you determine eligibility, calculate credit amounts, provide documentation to your payroll tax file, and support the tax position. We’ll also explain how applying for the credit impacts your Paycheck Protection Program (PPP) loan forgiveness.

The ERC provides an incentive for employers to keep their workforce employed during the COVID-19 pandemic in the form of a payroll tax credit. The credit is fully refundable against the employer share of its Social Security tax. The ERC is based on wages, compensation, and qualified healthcare expenses paid by eligible employers (Qualified Wages) from March 13, 2020 through December 31, 2021.

Businesses may not have considered the ERC in 2020 due to eligibility requirements, but those that received a PPP loan can now qualify for the ERC retroactively in 2020. Furthermore, eligibility requirements could be met for the applicable 2021 period.

Do You Qualify?

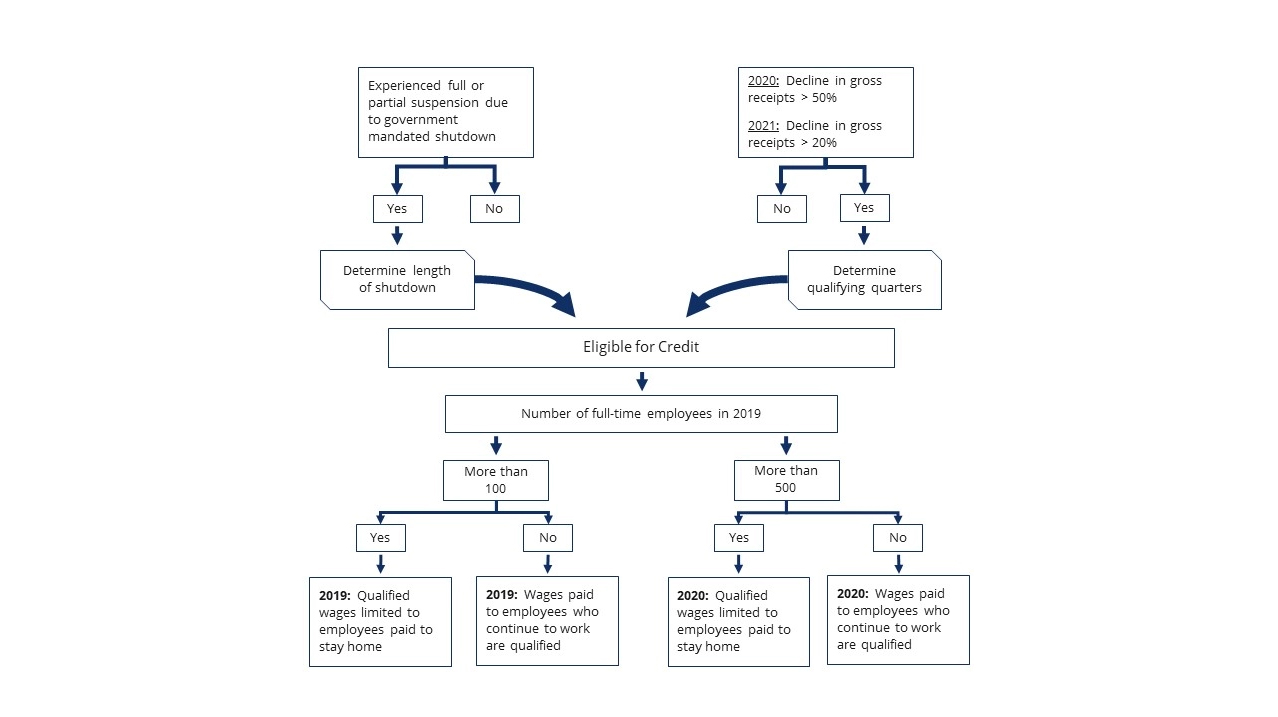

Both for-profit businesses and tax-exempt organizations can claim the ERC if they’re experiencing a significant decline in gross receipts or a shutdown by government order. If a business qualifies under either scenario, an employer can receive the ERC on a portion of Qualified Wages paid during qualified periods.

A decline in gross receipts is a mechanical computation. However, under certain facts and circumstances, qualifying for the credit under the mandated government shutdown can be a subjective exercise. Businesses must work with their tax advisor to understand any risk in taking advantage of the ERC.

Scenario 1: Decline in Gross Receipts

Decline in Gross Receipts Test – 2020

For quarters during 2020, gross receipts from a trade or business must be less than 50% of gross receipts from the same quarter in 2019. If met, a qualifying quarter is established. Once a qualified quarter is established, the subsequent quarter must only meet a 20% decline in gross receipts when comparing the subsequent quarter to its corresponding quarter in 2019.

In illustration, in comparing Q1 2020 to Q1 2019, there was a greater than 50% decline in gross receipts, and a qualified quarter is established for Q1 2020. In comparing Q2 2020 to Q2 2019, Q3 2020 to Q3 2019, and Q4 2020 to Q4 2019, decline in gross receipts are 30%, 19%, and 40%, respectively. Since there’s an established quarter in Q1 2020, Q2 2020 satisfies the lessened 20% criteria.

Hoever, Q3 2020 doesn’t meet the 20% lessened threshold. Therefore, there’s no qualified period wages during this period. Lastly, since Q3 2020 isn’t a qualified quarter, Q4 2020 would need to satisfy the 50% threshold. Since Q4 2020 is at 40%, wages paid during this period aren’t considered qualified wages.

Decline in Gross Receipts Test – 2021

The CAA provides taxpayer-friendly updates in the gross receipt calculation for the January 1, 2021 to December 31, 2021 period. During this period, a taxpayer is only required to have a decline in gross receipts of 20%. The 50% decline in gross receipts threshold from 2020 doesn’t apply to this period. In calculating gross receipts, a business compares receipts in that quarter to the same quarter in 2019, not 2020.

In addition, the 2021 test provides optionality in quarterly comparison. A business can elect to use the gross receipts from the immediately preceding quarter and compare these prior quarter gross receipts to the same quarter in 2019 rather than the current quarter. For example, for Q1 2021, a company can choose to compare Q4 2020 to Q4 2019.

Scenario 2: Government Mandated Shutdown

An employer whose trade or business operations are fully or partially suspended during a calendar quarter due to a governmental order is an eligible employer and is entitled to the ERC if it has a more than nominal impact to the business. It’s important to note that qualified wages that are used to compute the amount of credit available can only relate to the period in which wages were used as aid during the time of economic hardship (i.e. the period in which the business was shut down). A government order can either be a federal, state, or local mandate. Guidance defining what constitutes a full or partial suspension continues to be a grey area for many business, and we’re monitoring guidance as released.

ERC Eligibility Flowchart

Computation of the Credit

What are Qualified Wages and are You Under the Large Employer Threshold?

Qualified wages and compensation are defined in Internal Revenue Code (IRC) § § 3121(a) and 3231(e). Wages include, but aren’t limited to:

- Bonuses and commissions

- Cash tips

- Employees’ pre-tax contribution to a health plan

- Employer provided sick and vacation pay

- Qualified health plan expenses paid on the employees’ behalf

- Salaries and wages

Wages paid to individuals related to one another won’t qualify (e.g. wages paid to a person owning more than 50% of the value of the business and their family).

Large Employer Threshold

What constitutes qualified wages largely depends on your status as a large employer. Not exceeding the large employer threshold can significantly increase a business’s ERC. For example, a business with 101-500 full-time employees (FTEs) could go from having little to no benefit in 2020 to millions of dollars in benefits in 2021, due to the increased thresholds and increased qualified wage amounts.

For 2020, if the employer averaged more than 100 FTEs in 2019, only wages paid to an employee for the time that the employee wasn’t working during the period of economic hardship (either by means of the gross receipts test or the mandated government shutdown test) count as qualified wages.

For example, if a business had over 100 FTEs in 2019, only wages that were paid to employees to stay home and not work would be considered qualified wages. If the employer is under this threshold, then all wages paid to an employee—whether they were working or being paid to stay home and not work—would qualify during the period of hardship.

By extending the application of the ERC from January 1, 2021 through December 31, 2021, the CAA increased the large employer threshold from 100 to 500 and increased the cap on qualified wages. Rather than qualified wages being capped on an annual basis like the 2020 period, the 2021 period is capped on a quarterly basis.

In 2020, the annual cap was $10,000 qualified wages and the credit was limited to 50% of qualified wages (e.g. the maximum benefit per employee would be $5,000 in 2020). For 2021, the quarterly is $10,000 and the credit is limited to 70% of the credit (e.g., maximum credit of $7,000 per quarter/$28,000 per calendar year per employee in 2021). By way of example, an employer with 500 employees may not receive an ERC for the 2020 period, but could be eligible for a $14,000,000 credit in 2021. The credit could become even larger pending current legislation.

Claiming the Credit

Businesses can claim the ERC for 2020 and 2021 even if they received a PPP loan. The ERC is taken against the employer’s share of Social Security tax, which is filed on Form 941. Any excess is refundable under normal procedures. In filing for ERC retroactively, businesses should work with their payroll tax provider to amend Form 941. In anticipation of claiming this payroll tax credit, employers can retain a corresponding amount of the employment taxes that would have been deposited otherwise.

Eligible employers can also request an advance of the ERC by submitting Form 7200, Advance Payment of Employer Credits Due to COVID-19. If an employer has eligible tax credits for a quartering excess of employment tax deposits that would otherwise be due by the employer during the quarter, this form can be filed to request the advance payment of the excess credits from the IRS. If employers are claiming the payroll tax credit on Form 7200 and also use a professional employer organization (PEO), employers should work with the PEO to ensure accurate Form 941 reporting.

The ARPA extends the statute of limitations from three to five years relating to credits claimed for the calendar year quarters after June 30, 2021. The statute of limitations begins to run after the later of the date in which the original return claiming the credit is filed or treated as filed for Q3 and Q4 of 2021.

Impact on Federal Income Tax Return

IRC §280C Adjustment

The CARES Act provides that the ERC should follow rules similar to the IRC §280C which, in general, disallows a deduction for the portion of wages paid equal to the sum of certain credits determined for the taxable year. Per IRS Notice 2021-20, we expect a disallowance in deductible wages in the amount of the ERC received.

Interplay with Other Aspects of the Business

PPP Loan Forgiveness and Other Credits

Taxpayers that receive a PPP loan can now claim the ERC for the January 1, 2021 to December 31, 2021 period and retroactively for 2020. Although this change is beneficial to businesses, the same wages may not use the same qualified wages for both PPP forgiveness and ERC purposes. It’s currently unclear as to how wages reported as payroll costs on a previously filed PPP loan forgiveness application could impact the employer’s ability to claim the ERC for wages retroactively for the same period.

Financial Reporting Considerations

The ERC is a form of government assistance afforded under the CARES Act and CAA. The ERC is a payroll tax credit and isn’t within the scope of Accounting Standards Codification (ASC) 740-10, accounting for income taxes. As there isn’t U.S. Generally Accepting Accounting Principles (GAAP) guidance governing assistance in the form of a loan, income tax incentive, or credit, businesses should work with their auditors to apply the appropriate accounting standards.

Summary of Key Changes to ERC

|

ERC Changes |

Prior Law: CARES Act 3/13/20 – 12/31/20 |

New Law: CAA 3/13/20 – 12/31/20 |

New Law: CAA & ARPA 1/1/21 – 12/31/21 |

| PPP Loan & ERC Eligibility | Not eligible when forgiven PPP loan was received | Taxpayers that receive a PPP loan can claim the ERC. May not use the same qualified wages for both PPP forgiveness and ERC purposes. | |

| Maximum Creditable Wages Per Employee | $10k per year | No Change | $10k per quarter

$40k extended period |

| % Of Eligible Wages Converted Credit | 50% | No Change | 70% |

| Maximum Credit Per Employee | $5k per employee | No Change | $28k per employee |

| Large Employer Threshold | Greater than 100 FTE | No Change | Greater than 500 FTE |

| Maximum Small Employer Credit | $500k | No Change | $14M |

Please note: Pending legislation may extend and increase the amount of available benefit for 2021.